Revolutionizing Credit Risk: How AI-Powered Credit Evaluation Agents Are Transforming Finance

In today’s fast-paced financial world, traditional methods of credit evaluation are struggling to keep up with the demands of speed, accuracy, and scalability. The integration of AI in credit evaluation is no longer a futuristic concept—it’s a present-day necessity. Businesses are turning to intelligent automation to streamline credit risk assessment and make more confident lending decisions.

If you’re looking to reduce manual review cycles and improve creditworthiness insights, explore ZBrain’s AI-powered Credit Evaluation Agent—a game-changer in financial risk intelligence.

Why Traditional Credit Evaluation Is Broken

The Manual Bottleneck

For years, banks and financial institutions have relied on manual processes and siloed data to assess creditworthiness. Analysts sift through financial documents, transaction histories, and reports—a time-consuming, error-prone process that often leads to inconsistent results.

Data Overload and Inconsistency

With the explosion of digital data, especially unstructured financial records, teams are overwhelmed. The inability to tap into a centralized system for credit analysis creates blind spots and slows decision-making.

See also: Exploring the Impact of Technology on Cultural Exchange

Enter AI: Smarter Credit Evaluation at Scale

What Is an AI-Powered Credit Evaluation Agent?

An AI-powered Credit Evaluation Agent is a software agent trained to analyze financial data, assess borrower credibility, and produce real-time insights. Unlike traditional tools, these agents operate autonomously, evaluating structured and unstructured data using machine learning and natural language processing (NLP).

ZBrain’s Credit Evaluation Agent, for example, uses enterprise-grade orchestration to deliver accurate, explainable results within seconds. Whether it’s reviewing past payment behavior or analyzing cash flow statements, the agent ensures faster, more informed decisions.

Key Features of the ZBrain Credit Evaluation Agent

1. Automated Creditworthiness Assessment

The agent reviews financial statements, credit histories, and behavioral data to determine risk levels. It uses trained AI models to weigh variables like debt-to-income ratio, payment behavior, and income stability—ensuring accurate credit evaluation without human bias.

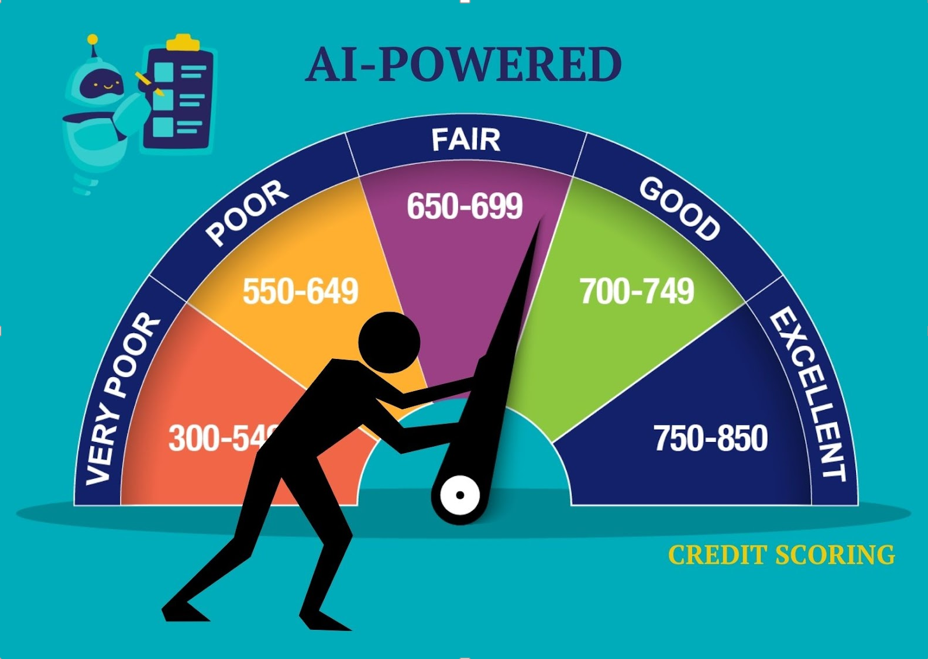

2. Real-Time Scoring and Recommendations

Need to approve a loan or extend credit on the fly? The AI agent provides real-time credit scoring and suggestions based on up-to-date financial inputs. This drastically cuts down turnaround time and enhances customer experience.

3. Intelligent Document Analysis

Manually parsing through balance sheets and P&L statements is a relic of the past. ZBrain’s agent uses OCR and NLP to read and understand financial documents, extracting insights from invoices, bank statements, tax filings, and more.

4. Scalable Across Use Cases

From SME lending to credit line reviews, the Credit Evaluation Agent supports multiple financial operations. Whether you’re a fintech, a bank, or an enterprise with an internal finance team, the solution adapts to your workflow and risk profile.

Benefits to Finance Teams and Lenders

Reduced Risk, Higher Confidence

Automated evaluation minimizes the risk of human error and subjective judgment. You get a standardized, bias-free assessment, helping your team make data-backed lending decisions with confidence.

Faster Decision-Making

With real-time analysis and scoring, loan approvals and credit evaluations move faster. This improves operational efficiency and enhances your service delivery.

Better Regulatory Compliance

The agent maintains audit trails, logs, and risk factors for each evaluation—making it easier to stay compliant with evolving financial regulations and internal policies.

The Power of ZBrain XPLR for Financial Intelligence

To further enhance credit evaluation, ZBrain offers ZBrain XPLR, a powerful exploratory AI interface that gives users access to centralized knowledge and decision intelligence. This means credit evaluators, risk officers, and finance leaders can:

- Ask natural language questions about credit trends

- Drill down into financial risk clusters

- Explore borrower history across departments

- Unify fragmented data sources into a single pane of insight

Combining ZBrain XPLR with the Credit Evaluation Agent supercharges your ability to understand credit behavior and future risk in real-time.

Real-World Applications

B2B Credit Line Reviews

Enterprises extending credit to other businesses can use the agent to review financial health before approval. This prevents revenue leakage and bad debt.

Fintech Lending

Fintech platforms can use the solution to automate user onboarding and loan approvals, enabling AI-driven underwriting and faster disbursement.

Corporate Finance

Internal finance teams can run risk checks on suppliers or partners before making significant purchases or entering joint ventures.

Getting Started with AI Credit Evaluation

If you’re ready to move beyond outdated credit models and embrace precision-driven risk intelligence, the time is now. AI-powered credit evaluation is no longer a luxury—it’s a strategic advantage.

Start your journey with ZBrain’s Credit Evaluation Agent. It’s time to empower your finance team with AI that thinks, learns, and evaluates like an expert.