How Much Home Can You Really Afford? A Practical Breakdown

Key Takeaways

- The 28/36 rule provides a widely used framework for assessing housing affordability.

- Understanding your debt-to-income ratio is essential for both financial health and loan qualification.

- Additional ownership costs and current market trends can significantly affect affordability.

- Down payment size, online calculators, and alternative housing options play vital roles in your decision-making process.

Table of Contents

- Understanding the 28/36 Rule

- Evaluating Your Debt-to-Income Ratio

- Considering Additional Homeownership Costs

- Impact of Rising Home Prices and Interest Rates

- Calculating Affordability with Real-Life Scenarios

- Exploring Alternative Housing Options

- Utilizing Online Affordability Calculators

- Final Thoughts

Understanding the 28/36 Rule

Navigating the home-buying process begins with an honest assessment of your finances. One fundamental guideline used by lenders and advisors is the 28/36 rule. This rule suggests that your monthly housing expenses—including mortgage, taxes, and insurance—should take up no more than 28% of your gross monthly income. Furthermore, your total debt obligations, including credit cards and auto loans, should not exceed 36%. Adhering to this helps prevent financial overreach and ensures you remain comfortable as a homeowner. If the numbers seem overwhelming, working alongside trusted professionals like Sonoma, CA real estate agents Shone Group can streamline your journey and shed light on local market conditions.

For example, if your gross monthly income is $5,500, keeping your monthly housing spending below $1,540 stays within the recommended threshold. This approach gives you flexibility, reducing the likelihood you’ll face payment stress down the road.

Evaluating Your Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is a critical metric that lenders scrutinize when you apply for a mortgage. There are two dimensions: the front-end ratio, which measures income against housing expenses, and the back-end ratio, which compares income to all recurring debts. For most, a healthy back-end DTI ratio is crucial not just for qualifying for a loan, but for maintaining financial stability as you take on new obligations.

This means that even if your housing payments are manageable, excessive car loans, student loans, or consumer debt could hinder your ability to qualify for favorable mortgage terms. Keeping your debt profile in check gives you greater leverage when negotiating with lenders and planning your long-term finances.

Considering Additional Homeownership Costs

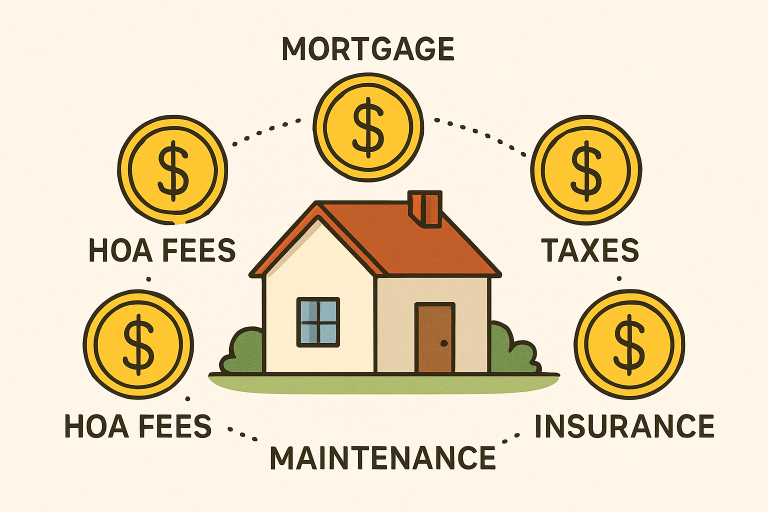

Owning a home extends well beyond the monthly mortgage payment. Expenses such as property taxes, homeowners’ insurance, yearly maintenance, and potential homeowners’ association (HOA) fees frequently add thousands to your annual costs. These hidden costs often catch first-time buyers off guard: for many, these extras can add $18,000 or more to their housing budget each year. Overlooking these leads to financial strain and may disrupt long-term plans, such as saving for retirement or travel.

Impact of Rising Home Prices and Interest Rates

The market climate in 2025 presents unique challenges. With the median home price in the United States reaching $410,800 in the second quarter, and average mortgage rates holding at 6.58% as of August, buying power has diminished for many. These changes impact monthly payments and can alter what buyers realistically afford. Staying informed about current conditions is essential when timing your purchase, especially for buyers hoping to secure a competitive rate or enter a particular neighborhood.

Calculating Affordability with Real-Life Scenarios

Let’s look at what this means in practice. If you aim to buy a $500,000 home and put 10% down, your estimated monthly housing costs could hit $4,042. This would require a gross annual income of roughly $161,680, factoring in the 28/36 rule. If you increase your down payment to 20%, your monthly obligation would drop to $3,666, which aligns with an annual income of $146,640. The ability to make a larger down payment not only lowers ongoing costs but can improve your capacity to negotiate favorable loan terms and reduce the risk of private mortgage insurance (PMI).

Exploring Alternative Housing Options

Today’s market requires flexibility, and alternative paths, such as renting or downsizing, can make sense for many households. Renting may allow you to accumulate savings or wait for more favorable purchase conditions. For others, downsizing aspirations for more manageable housing or lower-cost neighborhoods provides a practical compromise, enabling financial stability and long-term security.

Utilizing Online Affordability Calculators

One of the fastest ways to get personalized insights is by using a home affordability calculator. These interactive tools require you to enter your income, debt, and anticipated expenses, instantly estimating your realistic purchasing power. Integrating these calculators into your decision-making process gives you clarity and helps you set informed, attainable goals.

Final Thoughts

Knowing how much home you can afford goes far beyond simple mortgage estimates. By applying guidelines such as the 28/36 rule, managing your debt-to-income ratio, and thoughtfully accounting for market factors and additional expenses, you can make confident, informed decisions. Consider exploring a range of options and using online calculators to fine-tune your expectations. Staying thoughtful and proactive throughout the process ensures your path to homeownership is smooth and sustainable.